Master Guide on what firms should do with idle or surplus cash funds

- Linley Scorgie

- Jan 23

- 6 min read

Updated: 2 days ago

And why traditional cash management is losing you margin!

How Likwidity enriches the traditional cash management process? Higher margins. Better compliance.

Traditional Cash management is incomplete without cash optimization

Cash management does not end with cash forecasts or cash in the bank, earning sub-par rates. Organizations lose money through lost interest income that would boost earnings and extend runways

What is cash optimization and does it matter? Firms need a guide on what to do with idle or surplus cash funds

Traditional cash management activities include consolidating the information from various systems to identify cash flows from Account Receivable, Accounts Payable, Capex, Opex and measured against current liquidity with cash at bank or available facilities.

But too often, the process ends with cash in bank. And this is where the magic should happen.

With full automation, astute organizations can enhance yield on available cash, automate processes, meet compliance and equally important, have an ability to expand banking relationships to deliver on diversification and risk management. Many firms do not have a guide on what to do with idle or surplus cash funds

Remember: By far the majority of banks do NOT publish their corporate bank rates so organizations are in the dark about market-related rates.

Why it matters

Cash optimization can deliver massive bottom line benefits approximating $82,000 value for each $1m of cash. Do you own calculation here (https://www.likwidity.com/roicalculator

What are the typical questions a CFO/Treasurer/Director should be asking?

What is our forecast runway?

How much can we put away and for how long?

Where should we invest our cash?

Which bank is paying the best interest?

What is the credit rating of the banks we deal with?

How much should we invest per bank?

How long should we invest our funds for?

Can we have access to our funds?

What is the difference between bank deposits and money market funds?

What happens when the investment matures?

What is cash optimization and does it matter?

What is the typical process in the finance team

After establishing what the cash position and buffer is, the investment or placing process occurs

Finance teams then either call or email each of their banks to request a quote on bank deposit (Savings, Demand or Time deposits).

This will be repeated for each deposit that needs to be placed with banks.

Once the banks have responded, the information will be collated and compared to the following:

Are the rates within budget?

Will the best rate be within limit policies?

Once decided, the organization advises each of the banks on their decision

In some cases, a bank reference number is provided to link the deposit, rate and client.

The funds are transferred to the selected bank

The information is recorded on a spreadsheet to keep updated and calculate interest

The calendar is updated to remind when funds will mature

For month end purposes, the interest is calculated and graphs prepared for management accounts

When funds mature, the organization will decide on what action to take, i.e. roll over the funds or withdraw

In almost all cases, this is a manual process that would require a few hours to complete

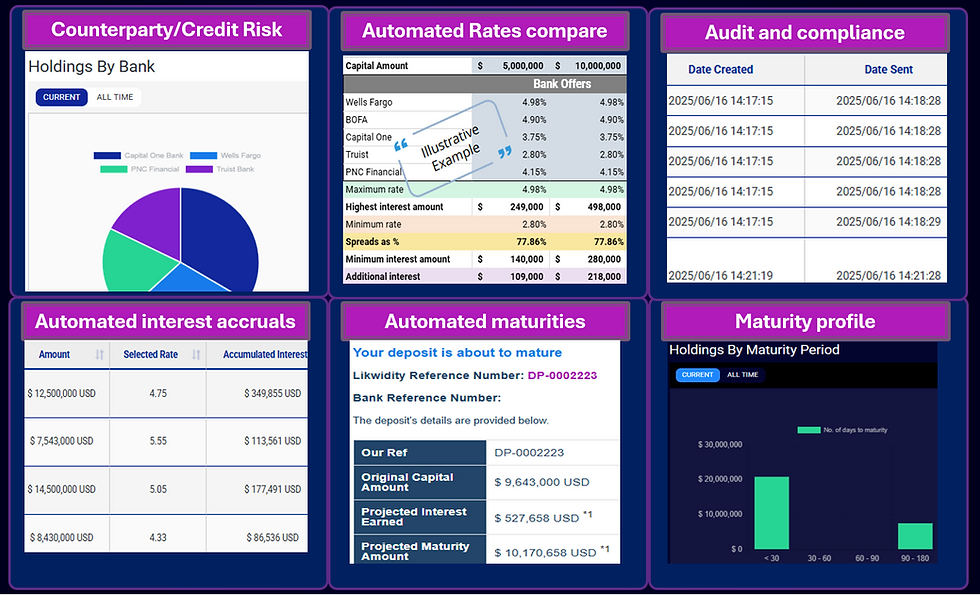

Likwidity will automate ALL of the above processes quickly and efficiently, except any settlements or transfer of cash funds. Automated cash optimization

Workflow

In addition, organizations will also get:

· Notification of rates offered by each bank

· Automated interest calculations

· Automated notifications of maturing deposits with option to roll over or withdraw funds

· Detailed audit trail of all transactions

· Ability to advise banks of early withdrawals

· Ability to request banks to re-price (improve) on quoted rates

Finance team's checklist for investing surplus or idle funds (Checklist)

· Cash forecasts-Tariffs and sanctions?

Always work with the latest cash forecasts and take AR/AP/Payroll/Tax and Capex into account.

· Emergency buffer

As part of the company policy, factor in an emergency buffer (whether percentage or actual amount) that will be available either on call or in your transaction bank for emergency funding requirements. Only the balance after the buffer should be invested.

· Diversification

Never have all assets tied up in a single account or bank

Have at least 2, preferably 3 banking relationships

Diversification is regarded as a cornerstone of all investments

· Duration

Match cash requirements to where and how you place the cash. (if you need funds in 30 days, then don't tie up with 60 days fixed deposits)

· Maturities

When placing cash, ensure that you have diarized when the deposit matures. Some banks will automatically renew your deposit if you forget to advise them and could tie up your funds for longer and may incur costs if you try and withdraw

· Limits

Set up a specific amount or percentage of funds allocated to a particular bank or institution. This ties back to diversification.

· Oversight

As with most finance processes, try and ensure the 4-eye policy to ensure that at least 2 people have insight into the cash investment decision. That's just good practice.

· Conflicts of interest

Relationships between internal staff and a bank official may be very close and could result in inadvertently adopting preferential treatment with that bank even though the outcome may not be in the company's best interest. Two ways of mitigating this would be to one, to ensure full audit trail and evidence of all offers and decisions and secondly, to facilitate role rotations.

· Audit trail and evidence

Depending on the method adopted, i.e. by email, telephone or digital, ensure that a full audit trail is available to validate and verify any investment decisions.

· Be aware of cash funds

Cash funds can be attractive places to invest cash funds but are also potentially very risky. By way of example, cash funds may have a higher return because they include other assets in the portfolio such as equities, private credit etc. These instruments are not cash and are not redeemable at request. By way of example, if a crisis erupts and the cash fund has to sell shares to repay your funds, then you may have to wait a long time and you may not get all of your funds back. Get expert advice on what each cash fund comprises.

· Bank credit rating

Organizations may choose a specific risk position. For example, only to invest cash with AAA rated banks, and for others, they may have a hybrid percentage in AAA/BBB banks

· Best interest duty

Generally, employees have a fiduciary obligation to act in the organization best interest. That would include ensuring that idle cash is generating the best/optimal return based on agreed guidelines

· Using a broker or intermediary

When using a broker/intermediary, ensure that the broker clearly sets out what their role and remuneration will be. In particular, get warranties that no hidden rebates or commissions are earned, and conflicts of interest is stated clearly, that you can clearly understand the net and final rates achieved.

· Examples of what can go wrong.

Banks run into liquidity problems. In case you think it won't happen, there are numerous examples of banks failing or having a run on liquidity

Unintended collusion between a bank official/broker and a staff member. The bank official could offer an inducement to attract a deposit offering a sub-par return

Banks have system issues that impacts availability to funds

Why does this matter?

· 39% of business cash sits in non-interest-bearing accounts (AFP®)

· At 5% rates, $1M in idle cash = $50K annual opportunity loss

· 65% still use manual treasury processes (MineralTree, 2023) T

· The majority of organizations still hold approximately 55% of short-term investments in bank deposits (AFP Liquidity Report).

Our dashboard will show

How much additional interest earned vs other rates

Funds allocated by bank to reflect diversification

Funds by credit rating to illustrate risk diversification

Funds maturity profile to show when funds are available

Limit utilization by bank to show adherence to limit pol

Likwidity role

Likwidity is NOT a broker and is a pure software tool charged on a fixed monthly fee. So no hidden commissions or rebates and client gets the full quoted rate by their bank.

Likwidity does not interpose between client and bank. We are a software tool, and organizations retain full control and engagement with their own bank and relationship managers. We aim to be invisible.

Likwidity does not receive or have access to organization cash funds or bank accounts.

Think of us as a plug-in between the accounting/ERP/Treasury systems

Other valuable resources

Comments